The Setup: How We Got Here

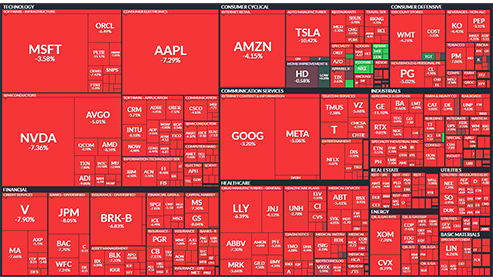

After a period of market resilience, today's session saw notable declines across major indices. The S&P 500 fell by 0.5%, the Dow Jones Industrial Average dropped 495 points (1.1%), and the Nasdaq Composite decreased by 0.6%. (AP News) This downturn was influenced by a combination of corporate earnings reports, economic indicators, and geopolitical developments.

The Inflection Point: What Changed Today?

Several key events converged to shift market sentiment:

-

Walmart's Cautious Outlook: Despite reporting strong holiday quarter earnings, Walmart issued a conservative sales forecast for the upcoming year, citing uncertainties in consumer spending and potential tariff impacts. This led to a 6.4% drop in its stock price. (AP News)

-

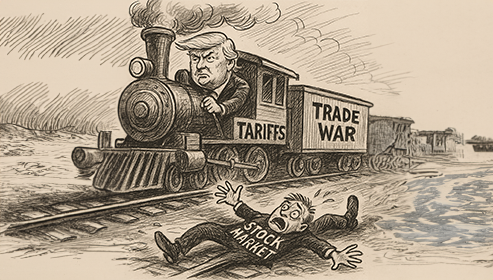

Geopolitical Tensions and Tariffs: President Donald Trump's announcement of potential tariffs on imports, including pharmaceuticals, autos, and semiconductors, has raised concerns about global trade dynamics. The lack of clarity on whether these tariffs will be broad-based or target specific countries has added to market volatility. (NASDAQ)

-

Economic Indicators: The U.S. Labor Department reported an unexpected rise in jobless claims, reaching 219,000 against the anticipated 215,000. This suggests potential softening in the labor market, contributing to investor apprehension. (Investors)

The Players: Who's Winning, Who's Losing?

-

Retail Sector: Walmart's stock decline had a ripple effect, with other retailers like Costco, Target, and Amazon also experiencing losses. (AP News)

-

Technology Sector: While the broader tech sector faced challenges, Microsoft reported a significant breakthrough in quantum computing with its Majorana 1 chip, leading to gains in shares of quantum computing companies such as D-Wave Quantum and Rigetti Computing. (Barron's)

-

Commodities: Gold prices surged to a record high of $2,954 per ounce amid escalating geopolitical tensions, indicating a flight to safety among investors. (The Guardian)

The Crossroads: Where Do We Go From Here?

The market stands at a critical juncture:

-

Investor Sentiment: The combination of cautious corporate forecasts, potential trade disruptions, and mixed economic data has introduced uncertainty.

-

Key Indicators to Watch: Upcoming economic reports, clarity on tariff implementations, and corporate earnings will be pivotal in determining market direction.

-

Strategic Considerations: Investors may need to reassess portfolios, considering diversification and potential hedges against increased volatility.

The Trader’s Take

In these turbulent times, it's essential to stay informed and adaptable. While challenges persist, opportunities arise for those prepared to navigate the complexities of the current market landscape.

WMT COST TGT AMZN